Welcome to ICSM Credit's special coronavirus newsletter

With the economy falling off a cliff I’m writing to you with the knowledge that many of you will be working from home and will be extremely worried about your business.

The overheads continue while those promises from the Chancellor Rishi Sunak may well not live up to the headline billing they were originally given. Red tape, delays and unhelpful banks mean few firms can utilise the loans available and furloughing staff puts many a CEO in a quandary as there appears no Government exit strategy to the lock down.

With more than 1,000 limited companies going to the wall every week (ref: Insolvency Service) it’s vital to chase down the money that you are owed including invoices however small that date back many months.

Act now:

Use your time to go through your ledger and urgently draw up a list of overdue accounts.

Use ICSM Credit’s FREE legal letters which have an 87% success rate within 14 days.

Use ICSM Credit’s Debt Collection Department to get the cash that should be in your bank.

According to Business Matters Magazine, added up the average UK SME has a monthly cash flow of £108,000 with £25,000 overdue at any one time. With business for many literally stopping on March 23 when the lock down started it means that most firms and small businesses have tens of thousands of outstanding unpaid invoices.

Anecdotally ICSM Credit have heard cash rich companies claiming the coronavirus crisis means they cannot settle accounts. Don’t take that as an answer as it’s just an excuse. Of course there are genuine hardship cases but those should be tackled diplomatically with a payment plan. In short with the lock down in place, ensuring you get paid is your number one priority – and as a member of ICSM Credit we will help you all the way.

Don’t hesitate to call or email ICSM Credit and make sure those outstanding invoices are paid during this critical period.

Best wishes

Ian Carrotte

Proprietor of ICSM Credit

For details about ICSM Credit call 0844 854 1850 or visit the website www.icsmcredit.com or email Ian at Ian.carrotte@icsmcredit.com

ICSM Credit, the Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR

Not a member? Join for less than a tank of diesel and protect yourself form late payers.

For a video on how to send a FREE LEGAL LETTER visit: https://youtu.be/AIycysoFhYo

ICSM DEBT COLLECTION

Paul Carrotte on ICSM Debt Collections on coronavirus excuses, the dangers of delaying and payment by credit card

With companies closed down or working with a skeleton staff Paul Carrotte said many are using the coronavirus crisis as an excuse not to pay overdue invoices.

The debt collection manager said: “A lot of firms don’t have any cash flow so they are squirrelling away their cash reserves if they have any. But they are not being paid so it’s a knock on effect. But they do have cash as they have to pay their own salaries. There are Government backed loans, whether they are genuine or of use I can’t comment but they are there. So there is no excuse not to pay but some companies are using the crisis not to pay anything.

“The quote I had from a debtor the other day was : ‘I’m not being paid, nobody is being paid and if the director of Wetherspoons announces that he’s not paying any suppliers until the pubs are reopened then you’ve got a fat chance of getting money out of anyone else.’ I think that summed it up pretty well.”

He said it was vital to try to track down the director or owner even to their home and speak to them on the phone if possible. One possibility that has worked with several clients is when you have got the relevant person on the phone to ask them to pay with a company credit card.

Company Credit Card

“Most directors and owners will have one on them so they can’t use the excuse of the accounts department is locked down at the office,” he said: “Company credit cards will usually have high limits so a lot of debts can be paid that way over the phone.”

With the crisis set to last into May and possibly longer it was important not to let overdue invoices lapse any further. He said: “It’s down to how much the client is prepared to invest in getting their money. Whether they will take legal action or instead sit tight and hope the money comes in. I feel they need to push harder because I can see what’s going to happen. The debtor will hide away their cash and then quietly fold the company and then phoenix again under a new name when the economy reopens. That action would mean all debts are written off and creditors won’t get paid anything.”

For details about ICSM Credit call 0844 854 1850 or visit the website www.icsmcredit.com or email Paul at paul.carrotte@icsmcredit.com on how to subscribe and to join the UK’s credit intelligence network to avoid bad debts and late payers. Follow ICSM Credit on FaceBook, Twitter and YouTube and Ian Carrotte on LinkedIn.

To see a video version of this newsletter visit https://www.youtube.com/watch?v=nJHjslhxoz8

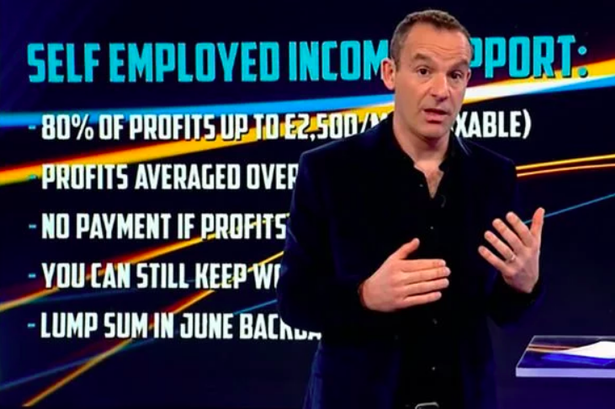

SELF-EMPLOYED

Financial experts explain who in the 5 million self-employed will or won't get help from the Government

Despite the long awaited plans by the chancellor Rishi Sunak for the self-employed outlined this week many will be left with nothing other than to claim benefits as business dries up.

The Government’s package promises to give the self-employed 80% of the their average monthly profits earned over the last three years up to £2,500. However those who have become self-employed in the last three years are left out, as are those in the gig economy and those on zero hours contracts but are effectively self-employed.

ICSM Credit’s Ian Carrotte said: “Nearly two million self-employed people will get no help from the scheme announced last night because they have only become self-employed recently such as those who own their own van or truck for deliveries. Start-up sign-makers and printers operating from a small business unit or even a lock-up are penalised as are a host of legitimate businesses who make up the backbone of the economy.”

Advice

The financial journalist and presenter of BBC Radio 4’s Moneybox programme Paul Lewis echoed Ian Carrotte’s words. He said: “It is wrong to say only 5% are left out. It is about a third including people who have started self-employment this tax year and those who make too little to pay tax.

“The Self-employed Income Support Scheme is based on profits not turnover. So people who have ploughed money back into capital expect to grow the business and taken little out as profits will get much less than those who have taken more out as profits.”

ITV

And the other Lewis, namely Martin Lewis of MoneySavingExpert.com appeared on ITV’s The Money Show soon after the chancellor’s announcements to help explain the scheme. He said: "The profits are averaged over three years. That's up to the 2019 tax year - the one that ended in 2019. If your profits are over £50,000 on average - even £50,000 and a penny - you don't get anything. It's a cliff-hanger. You can still keep working during this time.”

"It's paid as a lump sum in June, but it'll be backdated for three months. So, effectively, you'll get March, April and May's money in June as a lump sum."

Unanswered questions

There were many unanswered questions in the package said Ian Carrotte. He commented: “Many businesses don’t have the reserves if they have only been trading a short while and these last few months have been a lean time for a huge chunk of the economy. To ask firms to wait until June or later this summer will mean more firms going into administration or simply shutting up shop for good. We accept it is a complex job but time is of the essence and unfortunately Governments and their civil servants don’t work under the same time pressures the commercial sector does.”

Picture: Daily Express

INSOLVENCY RULE CHANGES

Coronavirus: company rule changes protect firms trading while technically insolvent

As companies lose footfall, orders and customers and see their cash flow disappear, the Government’s business secretary Alok Sharma has announced plans to protect firms who are technically insolvent during the coronavirus crisis.

The wrongful trading law is to be suspended so as to protect directors who pay staff and suppliers while their firm has a drastically reduced income or indeed no income at all. The business secretary announced he will make changes to enable UK companies undergoing a rescue or restructure process to continue trading, giving them breathing space that could help them avoid insolvency.

This will also include enabling companies to continue buying supplies, such as energy, raw materials or broadband, while attempting a rescue, and temporarily suspending wrongful trading provisions retrospectively from 1 March 2020 for three months for company directors so they can keep their businesses going without the threat of personal liability.

Personal liability rule change

Alok Sharma said: “The government is doing everything in its power to save lives and protect livelihoods during these unprecedented times. Applying a common-sense approach to regulation will ensure products are safe and reach the market without any unnecessary delay, getting vital protective equipment such as face masks to frontline staff as quickly as possible.”

Ian Carrotte of ICSM Credit said: “The measures are designed to keep businesses afloat during the crisis when they don’t in reality have any business. Department stores, shopping centres, chain stores and many manufacturers have been left high and dry and in normal circumstances would seek administration. With no end date to the crisis uncertainty has infected British business from top to bottom. The changes will help many firms survive the emergency.”

Chamber of Commerce view

The business minister said the wrongful trading law would be suspended to protect directors during the pandemic. The move will allow directors of companies to pay staff and suppliers even if there are fears the company could become insolvent.

For the British Chamber of Commerce Suren Thiru said: “Companies that were viable before the outbreak must be supported to ensure they can help power the recovery when the immediate crisis is over. Cashflow remains an urgent concern for many businesses, so it’s vital that government support packages reach businesses and people on the ground as soon as possible.”

ICSM Credit

For details about ICSM Credit call 0844 854 1850 or visit the website www.icsmcredit.com or email Ian at Ian.carrotte@icsmcredit.com on how to subscribe and to join the UK’s credit intelligence network to avoid bad debts and late payers. Follow ICSM Credit on FaceBook, Twitter and YouTube and Ian Carrotte on LinkedIn. To keep up to date subscribe to the FREE ICSM Credit Newsletter to hear all the latest insolvency news and to see who has gone out of business click on the orange panel on the top left of the home page of the website www.icsmcredit.com or send an email to Ian.carrotte@icsmcredit.com

BANK LOANS

Ian Carrotte tests the Government’s Coronavirus Business Interruption Loan Scheme – and finds it wanting

“It’s a joke,” said Ian Carrotte of ICSM Credit, “I applied for one just to see if I would be eligible. My business is profitable, I have savings and don’t need one but I thought I would test the system on behalf of ICSM Credit’s members.

“You have to go online to do it as of course unlike previous years it is almost impossible to go in and speak to someone at a branch. I completed the forms and requested a Coronavirus Business Interruption Loan with Nat West Bank of £20,000 for 12 months. Back came the answer: they said yes, but wanted my house as security.”

On April 3, 2020, the Chancellor Rishi Sunak has stepped in following widespread criticism of the lone scheme saying he will speak to the banks next week about the abuse of the system. He has announced lenders would be banned from requesting personal guarantees – which mean borrowers often have to put their homes on the line – on loans under £250,000.

The chancellor said the loan scheme would be extended so that it covered all small companies affected by Covid-19 and not just those unable to get commercial funding. There would be a new scheme to bolster support for larger firms not currently eligible for loans, under which the government would provide a guarantee of 80% so that banks could make loans of up to £25m to firms with an annual turnover of between £45m and £500m.

Sceptical

The measures have been welcomed by all the official trade bodies from the British Chamber of Commerce to the CBI, but Ian Carrotte remains sceptical.

“The chancellor will talk to the bank chiefs,” he said, “but will they listen? There’s no legislation forcing them to agree. Since a firm has to be in profit and well established to apply they will simply offer them a normal commercial loan and demand security in the form of the owner’s home or other property. The Government guarantees the Coronavirus Business Interruption Loan of 80% for the banks but the borrower takes all the risk.”

He is not a lone voice in the controversy surrounding the scheme. The Small Business website said banks are either wrongly understanding the scheme by asking for personal guarantees or are deliberately up-selling it, directing small businesses to take out regular business loans instead. They quoted Alex Harris, a publican in London who was steered towards a conventional business loan with a 22 per cent business rate instead of the government’s coronavirus loan scheme.

Left out

One sector the chancellor has failed to address said Ian Carrotte are the entrepreneurs and start-up businesses who are in their first few months and have yet to make a profit.

“The scheme refers banks to businesses that are 'viable,'” he said, “but that covers up to half a million workers who are employed by new companies. A new business can take months or even years to make a profit and appear viable. There is an upward growth pattern to their trading but banks will only want to see profits. These firms are being turned down by the scheme and referred to the high interest rates of a conventional business loan where security is demanded and interest rates can be as high as 22%. What a joke.”

Ian Carrotte said for businesses looking to survive one of the best options was to join the ICSM Credit circle as it has up to date credit intelligence on the commercial sector. For less than the cost of a tank of diesel firms large and small can get information on late payers and companies (often household names) in trouble and to be denied credit.

ICSM Credit

For details about ICSM Credit call 0844 854 1850 or visit the website www.icsmcredit.com or email Ian at Ian.carrotte@icsmcredit.com on how to subscribe and to join the UK’s credit intelligence network to avoid bad debts and late payers. Follow ICSM Credit on FaceBook, Twitter and YouTube and Ian Carrotte on LinkedIn.

WHO HAS GONE BUST RECENTLY

Runners and Riders

Below is a collated list taken from the Government’s London Gazette of businesses in the industry who are experiencing problems in the last few weeks.

Administrators Appointed

ATL Logistics Limited 43892

Birchley Hall Limited 43892

(The) Creative Engine Limited 43893

DJS (UK) Limited 43893

ER Travel Services Limited 43893

Great British Chefs Limited 43920

Kew Media Group UK Holdings Limited 43893

Kew Media Group UK Limited 43893

Kew Media International Limited 43893

Mad Dog Brewing Company Limited 43895

MBI Ferndale Limited 43892

MBI Lynwood Limited 43892

MBI Sandycroft Limited 43892

NWP Creative LLP 43922

R J Cadman Construction Limited 43892

S Walker Transport Limited 43893

Will Nixon Construction Group Limited 43893

Administrators Meetings Para 51

EBO Quality Signs Limited 43895

Compulsory Liquidators Appointed s 136

Giasullo Engineering Limited 43893

Creditors’ Voluntary Liquidation Deemed in Consent Meetings

A One Shopfronts Limited 43893

Armstrong Printing Group Limited 43920

Budget Bargains Limited 43892

Decellie Ltd 43893

Fizzthinks360 Limited 43892

Front Events Limited 43892

Graham Kitchens, Bathrooms and Bedrooms Limited 43892

Holiday Designers Limited 43924

Inconstruction Building Services Limited 43892

K D Construction and Management Services (Wales) Limited 43893

Laidmore Construction Limited 43893

MKR 94 Limited 43893

Newton Design Engineering Ltd 43893

Noahs Media Limited 43924

Noverre Retail Limited 43892

Prestige Windows, Doors & Conservatories Limited 43892

Profectus Marketing Solutions Limited 43921

Reflex Litho Limited 43920

(The) Riverside Chinese Limited 43892

Taxi Team Limited 43892

Westerhope Flooring Limited 43893

Workshop HR Solutions Limited 4389

Liquidators Appointed

Acropolis Design Limited 43901

Aim Design Company Limited 43915

Amazement Limited 43893

Atlantic Interior Limited 43893

Bicester Logistics Limited 43901

Blue Fashion Limited 43915

Bold Tyre Centre Limited 43892

Box of Allsorts Limited 43893

Brando Media Limited 43908

Brookside Press Design & Print Limited 43914

Brothers Plumbing Limited 43893

Cariad Café Bar Limited 43895

Chims Pizza Limited 43892

Cobs Bar Limited 43892

CG Kitchens & Bedrooms Limited 43893

Cold Laundry Limited 43893

Complete 24 Limited 43893

Craven Bar Co. Limited 43893

D S Couriers Limited 43901

D B Jewellery Design Limited 43915

EKV Design Limited 43895

FCL Finishing Limited 43901

Future Energy Group (UK) Limited 43893

Gov Construction Limited 43895

GTG Interiors Limited 43895

Harrogate Wedding Lounge Limited 43893

Hollingworth & Moss Limited 43924

Icon Marketing Limited 43915

Kari-C Design Limited 43915

J S B Joinery and Construction Limited 43892

JUT Solutions Limited 43892

(The) LCJ Group Ltd 43892

Liked Media Limited 43921

Main Street Displays Limited 43924

Marketing Gloucester Limited 43901

Mark Griffiths Design and Build Limited 43915

Matchmask Limited 43915

Media Jems Limited 43893

NG Takeaways Limited 43892

On Point Construction London Limited 43893

Pauls Haulage Limited 43893

Prelude Engineering and Design Limited 43923

Prestige Energy Limited 43901

PDS Dental Laboratory Leeds Limited 43893

Pollhill Floral Designs Limited 43920

(The) Print Academy (Yorkshire) Limited 43922

Printed Solutions Limited 43915

Promote My Brand Limited 43893

Ranny Logistics Ltd 43893

Reflex Litho Limited 43920

Remmer & Son Limited 43892

RMR Rail Limited 43892

See 3 Dimensions Limited LIMITED 43924

Seven Days Solutions Ltd 43921

S G Transport and Packaging Limited 43892

Sonex Media Limited 43915

Spectrum Welding and Engineering Supplies Limited 43892

Swift Office Stuff Limited 43920

Symposium Print Limited 43892

Tucan Building Ltd 43901

UK Book Binders (WSM) Ltd 43924

Viewable Media UK Limited 43901

World Sky Travel Limited 43892

Xandweb Ltd 43892

Members Voluntary Liquidations

Access Media Ventures Limited 43922

Alderwood Homes (NW) Limited 43892

A P Displays (Leicester) Limited 43893

A W S Appliance Spares Limited 43893

A. Mercer Limited 43893

Billingham Press Limited 43874

Brunel IT Consulting Limited 43893

Bill Wilkinson Consulting Limited 43892

Boston Rock Limited 43892

C G Evans (Property) Ltd 43892

Chainladder Limited 43892

Coastal Launch Services Limited 43893

Digital Edge Consulting Limited 43893

Cormorant Design Limited 43921

Dr Stephen Mark Wilkinson Limited 43893

Dunnhumby Advertising Limited 43895

EMS Support Limited 43892

ERP Stable Limited. 43892

EKV Design Limited 43874

French Soccer Limited 43874

Fastnet Digital Media Limited 43895

Fin Printers International Limited 43908

Fox & Hounds (Sinnington) Limited 43895

G&E Limited 43893

Greenbridge MOT Centre (Wiltshire) Limited 43874

G.G.A. Developments Limited 43893

Gale Creek Investments Limited 43893

Gaynor Consulting Services Limited 43893

Hannah Adam Limited 43892

Haien Limited 43893

Hooklands Yard Developments Limited 43893

Irene Fashions Limited 43892

Keys Consultancy Limited 43892

KSS Retail Limited 43895

Legal & Office Services Limited 43892

L. Chambers Motors Limited 43901

Mark Turpitt Cars Limited 43901

Mattison Public Relations Limited 43908

Pixel Paper Stone Limited 43908

Mayfly Media Limited 43920

Mimecast Development Limited 43892

Mossley Management Solutions Limited 43892

Media Circus Limited 43901

Medical Consultant Reports Limited 43893

MRM UK Consulting Services Limited 43893

Northern Truck Ltd 43874

PBS Design Limited 43892

P.K.K. Storage Limited 43895

Publishing Today Limited 43893

R & S Systems Limited 43893

Repro Arts Limited 43893

Roteq Engineering Limited 43893

R.A. Whiting Design Limited 43895

Scolaw Limited 43892

Simply Migrate Limited 43892

Taunton Design and Print Limited 43901

Trewfood Limited 43892

Penny Vincenzi Limited 43895

Vivid Outdoor Media (UK) Limited 43914

Worrall Lees Associates Limited 43892

Wright Manufacturing Services Limited 43893

Petitions to Wind Up

A1 Group (South) Limited 43893

Active Remedial Solutions Limited 43893

Cable & Climate Limited 43893

Cali Construction Resources Limited 43892

Digital Supermarket Limited 43924

Ellison Coating Systems Limited 43892

Essex Home Build Limited 43892

First Choice Couriers Limited 43896

Nicholls Builders Limited 43896

Poundbury Publishing Limited 43875

RJC Structural Design Limited 43896

Symposium Print Limited 43896

Trust In Media Limited 43896

T2 Build Systems Limited 43894

T M L Recycling Limited 43893

Winding Up Dismissal

R.D.F. Property Maintenance Limited 43892

IBB Builders Merchants Limited 43895

Winding up orders

Denova Design Limited 43895

Living Star Furniture Limited 43893

For information on ICSM visit www.icsmcredit.com or call 0844 854 1850.

ICSM, The Exchange, Express Park, Bristol Road, Bridgwater, Somerset TA6 4RR. Tel: 0844 854 1850. www.icsmcredit.com. Ian.carrotte@icsmcredit.com

|